Introduction: The Truth About School and Money

Most people are told that good grades lead to good jobs, and good jobs lead to financial success. While academic performance is valuable, it does not guarantee wealth.

Many highly educated people struggle financially because they never learned how to manage money, invest, or grow assets.

Financial education teaches you how to make money work for you, avoid financial traps, and build wealth over time. This article explores why understanding money is often more important than grades and how it can shape your future as an investor.

Financially Independant

Lesson 1: School Teaches You What to Think, Financial Education Teaches You How to Think

In traditional schooling:

- You memorize formulas and facts

- You pass tests

- You follow instructions

In financial education:

- You learn to analyze investments

- You understand cash flow

- You develop a wealth-building mindset

Example: Two students graduate with perfect GPAs.

- Student A only focuses on grades and works a high-paying job, but spends most of their income on liabilities.

- Student B learned about investing, saving, and passive income streams. They might start with the same salary but build assets that grow exponentially.

Financial literacy teaches decision-making skills that multiply your money.

Lesson 2: Understanding Money Is a Life Skill

Financial education covers areas schools rarely teach:

- Budgeting and saving

- Investing in stocks, ETFs, and precious metals

- Understanding liabilities vs. assets

- Avoiding debt traps

These skills are essential because:

- They protect you from making costly mistakes.

- They allow you to leverage opportunities others may miss.

- They create freedom and flexibility in your financial life.

Example: Knowing the difference between a high-interest credit card and a low-risk investment could save thousands of dollars over time.

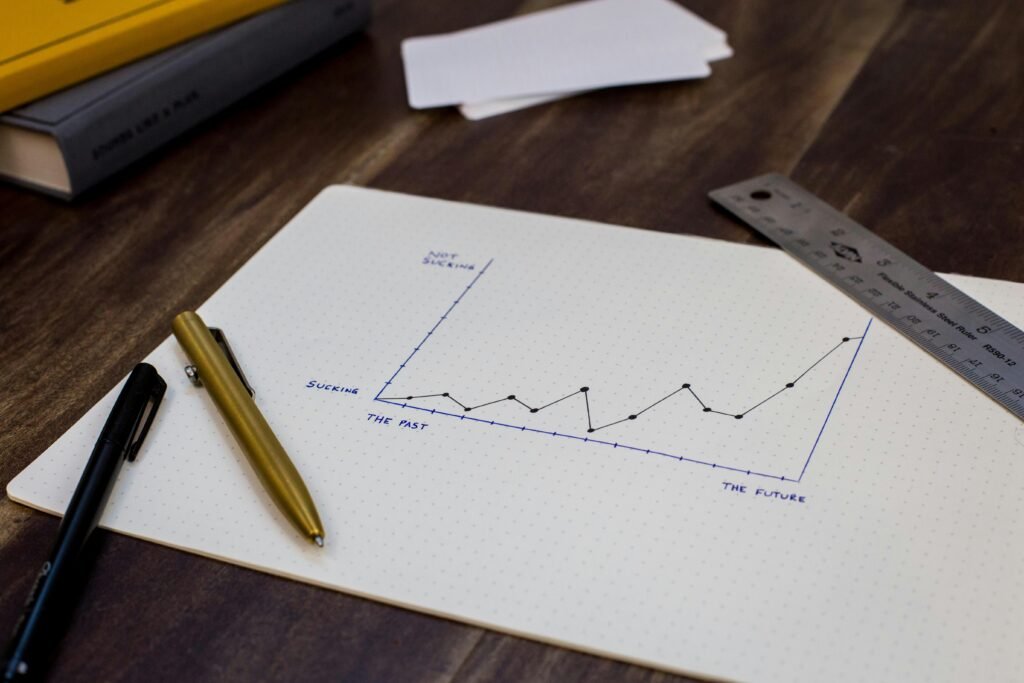

Lesson 3: Grades Don’t Teach You How to Grow Wealth

Even top students may lack the knowledge to:

- Build a diversified investment portfolio

- Understand the power of the snowball effect that multiplies revenue

- Take advantage of passive income opportunities

Financial education fills this gap. By understanding how money grows and how investments work, you gain control over your financial future, instead of relying solely on a paycheck.

Lesson 4: Real-World Examples of Financial Education Winning

Example 1: Investing Early

- Student A focused only on grades and saved $10,000 in a bank account.

- Student B learned about investing and put $10,000 into a diversified stock portfolio. Assuming an 8% annual return, after 10 years:

- Student A still has ~$10,000

- Student B has ~$21,589

- Student A still has ~$10,000

Example 2: Starting a Side Hustle

- Student A works part-time but spends all earnings on expenses.

- Student B starts a small blog, learns monetization strategies, and earns $200/month. Over 5 years, this generates $12,000 in passive income, which can be reinvested.

These examples show that knowledge about money and investments often outperforms academic achievements when it comes to building real wealth.

Lesson 5: Financial Education Prevents Common Money Mistakes

Many financially struggling adults:

- Accumulate high-interest debt

- Spend more than they earn

- Invest in haram or risky ventures unknowingly

By learning financial literacy early, you avoid these mistakes:

- Choose halal investments

- Diversify your portfolio

- Make calculated, risk-aware decisions

Takeaway: Money mistakes cost far more than a bad test score.

Lesson 6: Grades May Get You a Job, But Financial Education Can Make You Wealthy

Good grades can open doors, but wealth comes from knowing how to make money work for you. Investors understand:

- The snowball effect

- Asset allocation

- Long-term growth strategies

Even modest monthly investments can grow significantly over time. For example:

- Investing $300/month at 8% annual return for 10 years → ~$51,000

- Most people would never reach this by just saving their paycheck income

This shows how education about money outpaces traditional school success when it comes to building lasting wealth.

How to Get Financially Educated

Read books: Start with classics like Rich Dad Poor Dad, The Intelligent Investor, The Millionaire Next Door or our new Smart Money Moves: A Teen & Young Investor’s Guide to Financial Freedom.

Follow reputable financial blogs: Learn about stocks, ETFs, gold, and halal investing.

Track your finances: Budgeting and monitoring expenses is a practical lesson.

Start small investments: Even $50/month teaches you the basics of compounding

Join communities: Forums, online courses, or mentorships give real-world insights

Conclusion

School grades can open doors, but financial education builds freedom. Understanding money, investing wisely, and learning to manage assets vs. liabilities will pay off far more than a perfect GPA ever could.

Every investor — whether just starting or seasoned — benefits from financial literacy, because it teaches you how to make your money work for you, avoid mistakes, and grow wealth sustainably.

Invest in your knowledge today, and your future self will thank you for decades of financial growth and security.