Introduction

You’ve bought your first gold coins or bars — now comes the most important step: keeping them safe.

Whether you store them at home or in a secure vault, the goal is the same — to protect your investment from theft, loss, or damage.

This guide covers the best halal storage methods, their pros and cons, and how to choose the right one for your situation.

Financially Independant

1. Home Storage: The First Option

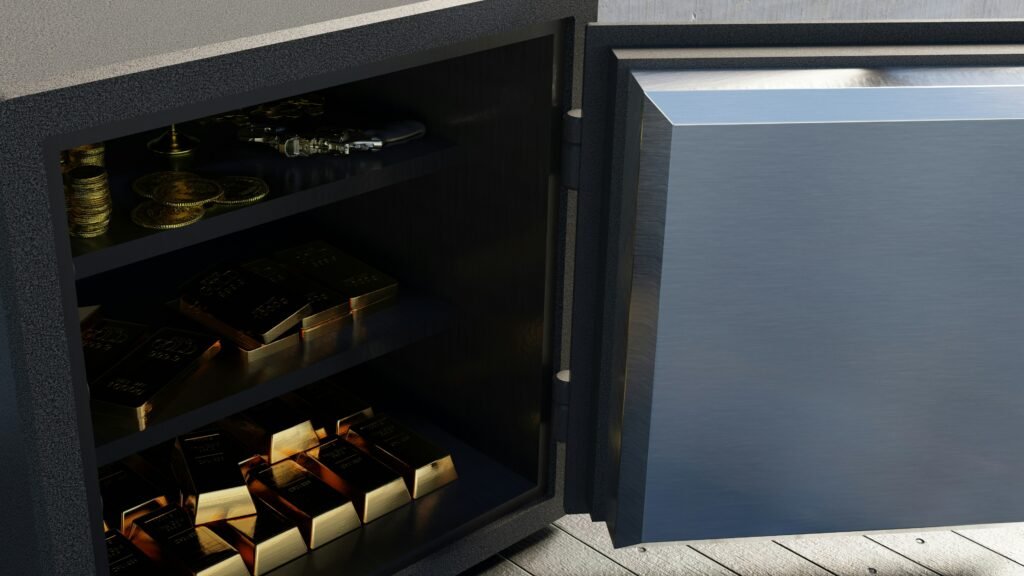

Fireproof & Waterproof Safes

- Best for small to medium amounts.

- Bolt to the floor or wall to prevent theft.

- Choose one with both key + combination access.

Tip: Place it in a hidden location — not the master bedroom (that’s where thieves look first).

Diversion Hiding Spots

- Hidden in false books, furniture, or containers disguised as household items.

- Useful for small amounts or fractional coins.

Halal Note: Storing at home is fully compliant as long as you remain the owner and there’s no interest-based insurance attached.

2. Bank Safe Deposit Boxes

Pros:

- High security.

- Monitored environment (less chance of fire/flood damage).

Cons:

- Access is limited to bank hours.

- Some banks restrict storing cash or high-value items without insurance.

Halal Note: Avoid boxes tied to interest-based insurance. If storage fees are flat-rate (not percentage-based on value), it’s generally halal.

3. Private Vault Storage

These are professional, non-bank facilities specializing in precious metals storage.

Pros:

- 24/7 monitored security.

- Often located in tax-advantaged areas (like vaults in Singapore or Switzerland).

- It can store large amounts safely.

Cons:

- Annual fees.

- Requires trust in the facility’s reputation.

Some dealers (like Silver Gold Bull in Canada) offer secure vaulting immediately after purchase, saving you from handling it yourself.

4. Split Storage for Maximum Safety

Many investors follow the “two-location rule”:

- Keep small amounts at home for easy access.

- Store larger amounts in a secure vault or safe deposit box.

This way, if one location is compromised, you still have the other.

5. Avoiding Common Storage Mistakes

- Telling people where you store your gold (even family/friends).

- Storing everything in one place — increases risk.

- Skipping insurance entirely — consider halal insurance (takaful) for big holdings.

- Not keeping records — always save receipts, certificates, and serial numbers.

6. Halal-Friendly Insurance Options

- Takaful: A cooperative, interest-free insurance model used in Islamic finance.

- Some vaulting companies offer takaful-based coverage — ask before signing up.

7. Which Storage Option is Right for You?

| Investor Type | Best Option | Why |

| Teen/Beginner | Small fireproof safe at home | Low cost, easy access. |

| Medium Holder | Split storage (home + bank) | Balanced security and accessibility. |

| Large Holder | Private vault | Highest security for big investments. |

Conclusion

Where you store your precious metals is just as important as what you buy. Start small with a fireproof safe, and as your gold and silver holdings grow, consider bank or private vault storage.

Always think in halal terms — avoid interest-based contracts, keep full ownership, and maintain control over your wealth.

By protecting your investment, you’re securing not just gold, but your financial future.